Enterprise LAN vendors providing access layer connectivity must respond to changing demands. Infrastructure and operations leaders should evaluate vendors based on their ability to provide an intelligent access layer capable of network automation that addresses all of the business requirements.

Strategic Planning Assumption

By 2022, more than 60% of IT organizations will use access layer network automation, up from less than 5% today.

Market Definition/Description

Gartner’s view of the market is focused on the vendor’s ability to anticipate and integrate transformational technologies or approaches delivering on the future needs of end users. Gartner defines the wired and wireless LAN access infrastructure market as a market that consists of vendors supplying wired and wireless networking hardware and software that enables devices to connect to the enterprise wired LAN or Wi-Fi network. These devices may include laptops; smartphones, tablets and other mobile smart devices; networked office equipment; sensors and other Internet of Things (IoT) endpoints; and other fixed or mobile endpoints communicating to a wired switch port or a wireless access point at the edge of the enterprise infrastructure. This research does not cover wired and wireless access networking infrastructure for adjacent markets, such as public venues, small office/home office, commercial and industrial settings, or point-to-point solutions.

Enterprise wired and wireless local-area networking components include:

- Software — Network service applications that are cloud-based or deployed on an appliance or virtual appliance, including but not limited to:

- Network management

- Network monitoring

- Guest access

- Onboarding services

- Authentication, authorization and accounting (AAA) security

- Policy enforcement

- Intrusion detection systems/wireless intrusion detection systems

- Location services

- Performance management

- Network assurance

- Application visibility

- Network and vertical market analytics

- Security including behavioral analysis

- Hardware — Physical network elements including:

- Wireless access points

- Wired switches

- Controllers, if needed

Vendors serve enterprises with three distinct go-to-market approaches:

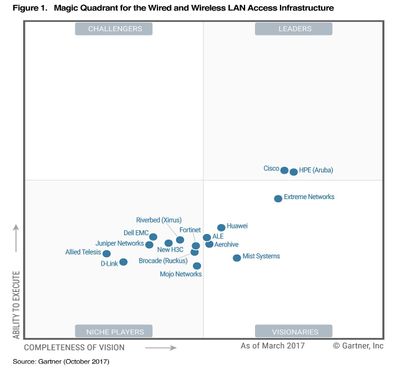

- The vendor provides its own wired and wireless infrastructure components, network applications and services. Examples include Cisco, Hewlett Packard Enterprise (HPE) Aruba, Extreme Networks and Huawei.

- The vendor primarily provides a specific connectivity option, such as either wired or wireless components. These vendors often focus on solutions addressing a unique set of market requirements, such as cloud-based management of a predominantly wireless LAN (WLAN) or a vertical market, such as retail or healthcare. Examples include Aerohive, Mist Systems and Mojo Networks.

- The vendor uses a strategic partner to provide some or all of the hardware or software components of an end-to-end access solution. These vendors provide differentiating functionality in the network applications for the combined solution. Examples include Dell and Juniper Networks.

Vendor Strengths and Cautions

[to continue, click HERE]